debt consolidation loans UK Unraveling Financial Freedom

Debt consolidation loans UK are a beacon of hope for those navigating the stormy seas of financial strain. Imagine merging multiple debts into one manageable monthly payment, simplifying your financial landscape and potentially lowering your interest rates. This powerful tool not only aims to alleviate stress but also paves the way for a more organized financial future.

As we delve deeper into the world of debt consolidation loans, we will explore their purpose, the various types available in the UK, eligibility criteria, and the intricacies of the application process. We’ll also examine the impacts on your credit score, compare alternatives, and even uncover success stories that inspire. Join us on this journey to understand how debt consolidation could be your stepping stone to financial liberation.

Understanding Debt Consolidation Loans in the UK

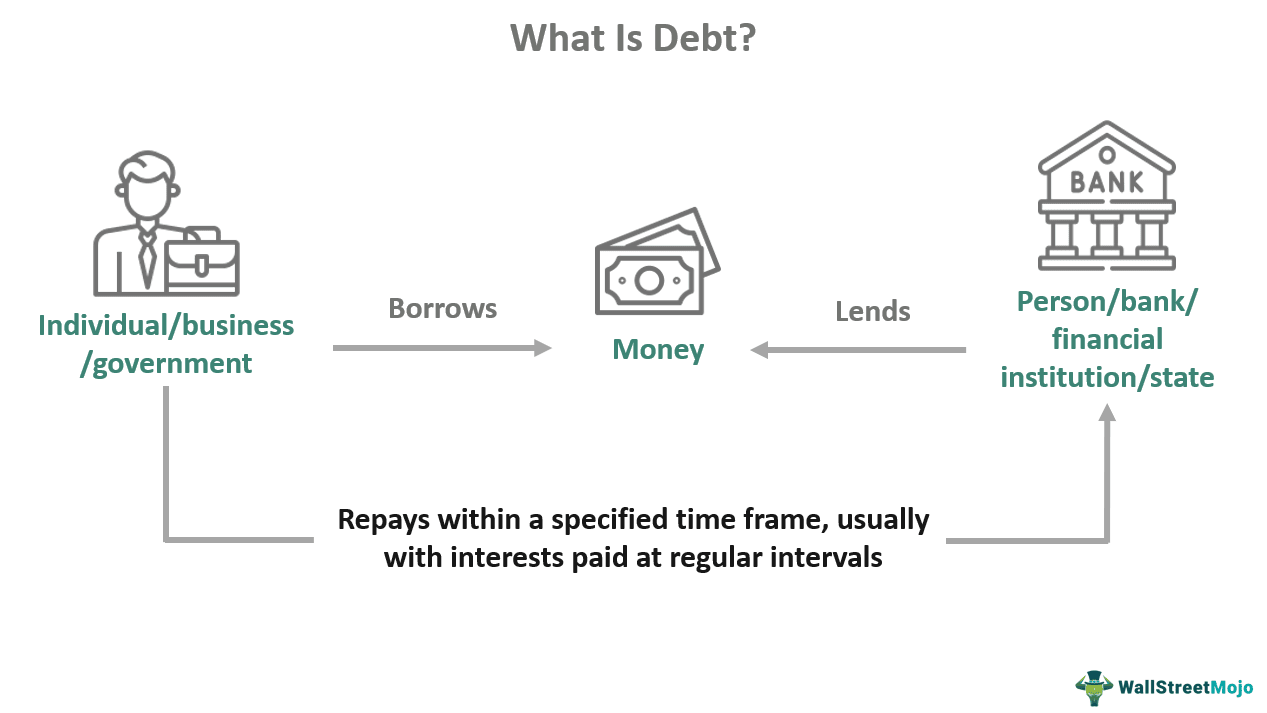

Debt consolidation loans are financial tools designed to simplify the management of multiple debts by combining them into a single loan. The primary purpose is to help borrowers reduce monthly payments, lower interest rates, or both, ultimately making it easier to pay off debts over time. In the UK, these loans can be a lifeline for those struggling to navigate the complexities of varied interest rates and payment schedules that come with several debts.The process of obtaining a debt consolidation loan in the UK typically begins with assessing your current financial situation, including all outstanding debts.

After gathering this information, borrowing options can be explored through banks, credit unions, or online lenders. Applicants will usually need to provide proof of income, employment details, and information about their existing debts. Lenders will assess creditworthiness, which may involve a credit check. Upon approval, the new loan is used to pay off existing debts, leaving the borrower with a single monthly repayment to manage.

Advantages of Debt Consolidation Loans

Debt consolidation loans offer numerous benefits that can significantly improve financial management for individuals. Here are some of the key advantages:

- Single Payment: Consolidating debts streamlines repayment by reducing multiple payments into one, making budgeting simpler.

- Lower Interest Rates: Many debt consolidation loans offer lower interest rates compared to credit cards or unsecured loans, resulting in savings over time.

- Improved Credit Score: As borrowers pay off existing debts, they can improve their credit score, enhancing future borrowing opportunities.

- Fixed Payment Terms: Debt consolidation loans often come with fixed repayment terms, providing certainty about how long repayments will last and how much will be paid each month.

Disadvantages of Debt Consolidation Loans

While advantageous, debt consolidation loans also come with potential drawbacks that borrowers should keep in mind. The following points highlight some of the disadvantages:

- Potential for Higher Overall Costs: If the repayment term is extended, borrowers may end up paying more in interest over the life of the loan.

- Risk of Accumulating More Debt: Without financial discipline, individuals may continue to accumulate new debts after consolidation, leading to a worse financial situation.

- Impact on Credit Score: Initially, applying for a debt consolidation loan may temporarily lower your credit score due to the hard inquiry made by lenders.

- Secured Loans Risk: If a debt consolidation loan is secured against an asset, like a home, there’s a risk of losing that asset if unable to make payments.

“Debt consolidation can be a powerful tool if used wisely, but it requires thoughtful consideration and a commitment to managing finances responsibly.”

Types of Debt Consolidation Loans Available in the UK

In the realm of financial management, debt consolidation loans offer a beacon of hope for those grappling with multiple debts. In the UK, various types of debt consolidation loans can assist individuals in streamlining their finances and managing repayments more effectively. Understanding these options is pivotal in selecting the right solution for your financial needs.Debt consolidation loans come in different forms, each tailored to meet varying circumstances and preferences.

The two primary categories are secured and unsecured loans. A secured loan requires collateral, such as a property or vehicle, which means that the lender can claim the asset if the borrower defaults. In contrast, unsecured loans do not require collateral but generally come with higher interest rates due to the increased risk for lenders. Assessing your financial situation will help determine which option aligns with your requirements.

Secured and Unsecured Debt Consolidation Loans

Secured loans often offer lower interest rates because the lender has a safety net in the form of the asset pledged. Borrowers using their homes as collateral can access larger amounts and longer repayment terms, making it an appealing choice for significant debt reduction. However, this comes with the risk of losing the asset if payments cannot be maintained.Unsecured loans, while lacking the requirement for collateral, typically feature higher interest rates and stricter eligibility criteria.

They are designed for those who prefer not to risk their assets and may be more suitable for individuals with stable incomes and good credit histories. The following table provides a comprehensive comparison of various types of debt consolidation loans available in the UK, illustrating their key features:

| Loan Type | Interest Rate | Repayment Term |

|---|---|---|

| Secured Debt Consolidation Loan | 3% – 7% | 5 – 30 years |

| Unsecured Debt Consolidation Loan | 7% – 20% | 1 – 10 years |

| Personal Loan for Debt Consolidation | 6% – 18% | 1 – 7 years |

| Debt Management Plan (DMP) | Varies | 3 – 5 years |

| Home Equity Loan | 3% – 6% | 5 – 30 years |

These options illustrate the diverse landscape of debt consolidation loans in the UK, enabling borrowers to make informed decisions based on their financial situations. Each type carries distinct features, advantages, and potential drawbacks, making it essential to evaluate personal circumstances thoroughly before committing to a loan solution.

Eligibility Criteria for Debt Consolidation Loans

When considering a debt consolidation loan, it’s essential to understand the eligibility criteria that lenders typically use to assess potential borrowers. These criteria help ensure that both the borrower and the lender are on the same page regarding what is required for a successful loan application. Understanding these factors can better equip you in your journey toward financial freedom.Lenders evaluate various aspects of an applicant’s financial background to determine creditworthiness.

This assessment usually includes the applicant’s income, existing debts, credit history, and overall financial behavior. Each lender may have specific requirements, but certain common criteria are generally observed across the board.

Typical Eligibility Requirements

To successfully obtain a debt consolidation loan, potential borrowers should familiarize themselves with the standard eligibility requirements. These criteria can vary slightly from lender to lender, but the following points are commonly considered:

- Age: Applicants must be at least 18 years old, as this is the legal age for contract agreements in the UK.

- Residency: Most lenders require applicants to be UK residents and to have a permanent address.

- Income: A steady income source is crucial. Lenders often expect proof of income through pay slips or bank statements.

- Credit Score: A good credit score is often a requirement, as it indicates the borrower’s reliability in repaying loans. Scores above 600 are generally considered acceptable.

- Debt-to-Income Ratio: Lenders assess the ratio of monthly debt payments to monthly income. A lower ratio suggests better financial health.

Factors Lenders Consider for Creditworthiness, Debt consolidation loans UK

Lenders delve deeper into an applicant’s financial profile to evaluate creditworthiness. The following factors play a crucial role in this analysis:

- Credit History: A detailed record of past borrowing and repayment behavior, including any defaults or missed payments, is thoroughly reviewed.

- Current Debt Levels: Lenders examine the total amount of existing debt, including credit cards and personal loans, to assess the applicant’s overall financial burden.

- Employment Stability: A stable job history is favorable, as it indicates a consistent income stream that can be relied upon for loan repayment.

- Loan Purpose: The intended use of the loan may also be considered, as lenders prefer funding that consolidates existing debts rather than for new expenses.

Eligibility Checklist for Borrowers

Before applying for a debt consolidation loan, potential borrowers can assess their eligibility using the following checklist. Completing this checklist can provide clarity on whether one is prepared to move forward with the application process:

- Are you at least 18 years old and a UK resident?

- Do you have a steady source of income?

- Is your credit score above the minimum required threshold?

- Have you reviewed your current debts and calculated your debt-to-income ratio?

- Is your employment situation stable with a consistent job history?

- Have you ensured that the purpose of the loan aligns with lender expectations for debt consolidation?

The Application Process for Debt Consolidation Loans

Applying for a debt consolidation loan in the UK can be a transformative step towards regaining control over your finances. This journey, while seemingly daunting, can help simplify your financial landscape and reduce the stress of multiple debts. Understanding the application process is crucial as it enables you to navigate the terrain smoothly and avoid potential pitfalls that could derail your plans.The application process for a debt consolidation loan typically involves several key steps that ensure you are well-prepared and informed before making your decision.

Here, we will Artikel the essential steps of applying, the documentation you will need, and common mistakes to avoid to enhance your chances of approval.

Steps Involved in Applying for a Debt Consolidation Loan

Embarking on the application for a debt consolidation loan requires careful planning and organization. The following steps illustrate the typical process:

1. Assess Your Financial Situation

Begin by taking a close look at your current debts, monthly expenses, and income. Understanding your total debt and cash flow provides a solid foundation for your application.

2. Research Lenders

Not all lenders offer the same terms. Comparing different lenders’ interest rates, repayment periods, and fees ensures you find the best option tailored to your needs.

3. Check Your Credit Report

Your credit score plays a pivotal role in the loan approval process. Obtain a copy of your credit report and rectify any inaccuracies that may negatively impact your score.

4. Calculate Loan Amount

Determine how much money you need to borrow. This should be enough to cover all your existing debts, with a little extra for any unforeseen expenses.

5. Gather Documentation

Prepare to submit various documents to support your application.

Documentation Needed During the Application Process

To facilitate a smooth application process, specific documentation is often required by lenders to verify your financial status and ensure you meet their criteria. The following documents are typically necessary:

Proof of Identity

This may include a passport or driver’s license.

Proof of Income

Recent payslips or bank statements showing your income.

Details of Existing Debts

A list of all current debts, including balances, monthly payments, and terms.

Credit Report

Though lenders may obtain this themselves, you can provide your copy to expedite the process.Having these documents ready can significantly speed up your application and increase the likelihood of approval.

Common Mistakes to Avoid When Applying for These Loans

Navigating the application process can be tricky, and several common missteps can hinder your chances of securing a debt consolidation loan. Recognizing and avoiding these can lead to a more successful outcome.

Neglecting to Shop Around

Failing to compare multiple lenders can lead to missing out on better rates and terms.

Overborrowing

Asking for more than you need can lead to higher monthly payments and interest costs, which may defeat the purpose of consolidation.

Ignoring Credit Health

Not addressing issues on your credit report before applying can result in rejection or unfavorable terms.

Underestimating Costs

Failing to factor in potential fees associated with loan origination or early repayment penalties can lead to financial strain down the line.Being aware of these common pitfalls allows you to approach your application process with a more strategic mindset, ultimately increasing your chances of securing the best deal for your circumstances.

Costs and Fees Associated with Debt Consolidation Loans

When considering a debt consolidation loan, it’s crucial to understand not only the amount you can borrow but also the costs and fees that accompany these loans. These expenses can significantly affect the overall financial impact of your decision, especially if you’re aiming to simplify your debt management and reduce monthly payments. Being fully aware of the associated costs helps you make informed financial choices and avoid surprises down the line.Several common fees are typically associated with debt consolidation loans.

These can include setup fees, interest rates, and potential penalties for early repayment. It’s essential to scrutinize these costs as they can vary widely among lenders. Besides the visible fees, there may also be hidden costs that can catch borrowers off guard, such as servicing fees or charges for late payments. Understanding these costs is key to navigating your options wisely.

Common Fees and Potential Hidden Costs

Before proceeding with a debt consolidation loan, it’s vital to grasp the different fees that could arise. Here are some commonly encountered costs and potential hidden fees:

- Setup Fees: These fees may be charged when you take out the loan, often expressed as a percentage of the loan amount.

- Interest Rates: The main cost of a loan, which can vary based on your credit history and the lender’s terms.

- Monthly Payment Fees: Some lenders may charge fees for processing your monthly payments.

- Early Repayment Fees: This fee applies if you pay off your loan before the end of the term, which some lenders enforce to recoup lost interest revenue.

- Late Payment Fees: Charges incurred if a payment is not made by the due date.

- Credit Insurance: Optional insurance that some lenders may offer, which could add to the overall cost of the loan.

Awareness of these costs enables borrowers to compare loans effectively and choose the one that offers the best deal for their situation.

Comparison of Total Loan Costs from Different Providers

A comprehensive comparison of loan providers can illuminate the varied costs associated with debt consolidation loans. Below is a table showcasing the total costs based on a hypothetical loan amount of £10,000 over a five-year term from three different lenders:

| Lender | Interest Rate (%) | Setup Fee (£) | Monthly Payment (£) | Total Cost (£) |

|---|---|---|---|---|

| Lender A | 6.5 | 300 | 198 | 11,880 |

| Lender B | 7.2 | 150 | 204 | 12,300 |

| Lender C | 5.9 | 500 | 192 | 11,500 |

In this example, while Lender C has a higher setup fee, their lower interest rate results in the lowest total cost over five years. This illustrates the importance of not only considering the interest rate but also the overall cost, including any upfront fees.Understanding and evaluating these costs will empower you to make a more informed decision regarding your debt consolidation loan options in the UK.

With careful consideration, you can consolidate your debts effectively while minimizing unnecessary expenses along the way.

Impact of Debt Consolidation on Credit Score

When embarking on the journey of debt consolidation, it’s essential to understand its potential impact on your credit score. This pivotal number not only influences your ability to secure loans in the future but also affects the interest rates you may be offered. Debt consolidation can serve as a financial lifeline, but it comes with its own set of implications for your creditworthiness.Taking out a debt consolidation loan can trigger various changes in your credit score, making it essential to assess both the positive and negative effects.

In the short term, applying for a new loan might result in a slight dip in your score due to the hard inquiry generated by the lender. However, as you manage your new loan effectively—making timely payments and reducing overall credit utilization—your score can improve over time. It’s a balancing act between immediate effects and long-term benefits that requires strategic navigation.

Short-term Effects of Debt Consolidation

Initially, the consequences of obtaining a debt consolidation loan can be mixed. While it may provide relief by consolidating multiple debts into one manageable payment, the process can temporarily lower your credit score. Key factors influencing this short-term impact include:

- Hard Inquiry: Every time you apply for a loan, the lender performs a hard inquiry on your credit report, which can reduce your score by a few points.

- New Credit Account: Opening a new account affects your average account age, which is a factor in calculating your credit score.

- Balance Changes: Paying off existing debts may lower your total debt load, positively influencing your score but not instantly.

Long-term Effects of Debt Consolidation

In the long run, the impact of debt consolidation can be significantly positive if managed wisely. Here’s how taking control of your debt can lead to credit score improvement:

- Improved Payment History: Consistently making on-time payments on your new loan demonstrates reliability to creditors, positively affecting your score.

- Lower Credit Utilization: Reducing the amount of credit used by consolidating debts can boost your score, as credit utilization is a crucial factor in credit scoring.

- Increased Financial Stability: Successfully managing a single loan instead of multiple debts can lead to better financial habits and, in turn, a healthier credit score.

“A strong credit score can open doors to lower interest rates and better financial opportunities.”

Strategies for Managing Credit Score Post-Consolidation

Successfully navigating the credit landscape after consolidating debt requires proactive strategies to ensure your score remains in good standing. Consider the following approaches:

- Create a Budget: Establish a monthly budget that prioritizes debt repayment while allowing for savings and discretionary spending.

- Monitor Your Credit Report: Regularly review your credit report for inaccuracies or areas for improvement, as this awareness can help you rectify issues before they become significant problems.

- Use Credit Wisely: Avoid accumulating new debt while managing your consolidation loan to maintain a low credit utilization ratio.

- Build an Emergency Fund: Having a financial cushion can prevent the need to rely on credit in case of unexpected expenses.

Alternatives to Debt Consolidation Loans

When facing financial turmoil, many individuals gravitate towards debt consolidation loans as a means to alleviate their burden. However, it’s vital to explore other avenues that might suit different circumstances better. Various alternatives can provide the necessary relief from debt while potentially offering more flexibility or lower costs. One popular option is a debt management plan (DMP). This structured repayment strategy is designed for those struggling to keep up with multiple debts.

A DMP allows you to consolidate your payments into a single monthly installment, often at a reduced interest rate or with waived fees.

Debt Management Plans versus Debt Consolidation Loans

Understanding the differences between debt management plans and debt consolidation loans can help individuals make informed decisions. Debt Management Plans (DMPs):

- A DMP is an arrangement with creditors through a certified debt management company. You make a single monthly payment to the company, which then distributes the funds to your creditors.

- DMPs typically do not involve taking out a loan, meaning you won’t incur new debt.

- They can lower monthly payments and may lead to waiving certain fees or reducing interest rates.

Pros:

- Simplifies monthly payments into one.

- Reduces interest rates and fees.

- Helps avoid bankruptcy.

Cons:

- Can affect your credit score during the repayment period.

- Not all creditors will agree to a DMP.

- Typically lasts 3 to 5 years.

On the other hand, Debt Consolidation Loans involve taking out a new loan to pay off existing debts, essentially consolidating them into a single payment with potentially lower interest rates. Pros:

- Lower interest rates than individual debts can lead to savings.

- Can improve your credit score if managed well post-consolidation.

Cons:

- Risk of accumulating more debt if spending habits don’t change.

- Defaulting on the loan can severely impact credit scores.

Exploring various alternatives to debt consolidation loans can empower individuals to find the best solution for their unique situations. Here are several alternatives to consider:

- Balance Transfer Credit Cards: These allow you to transfer existing credit card debt to a new card with a lower interest rate, sometimes even 0% for a promotional period.

- Debt Settlement: Involves negotiating with creditors to reduce the total amount owed. However, this can severely impact your credit score.

- Bankruptcy: A legal process to eliminate or repay debts, which can provide a fresh start but comes with long-lasting effects on your credit history.

- Credit Counseling: Professional advisors can help create a personalized budget plan and may negotiate terms with creditors on your behalf.

- Personal Loans: Unsecured personal loans can be used to pay off high-interest debts. They often come with fixed interest rates and terms.

- Family or Friends Support: Borrowing money from loved ones can be a viable option, often with more flexible repayment terms.

- Government Assistance Programs: Various programs exist to help those in financial distress, providing grants or interest-free loans in specific situations.

Each alternative comes with its own set of advantages and considerations, making it essential to evaluate what aligns best with individual financial situations and long-term goals.

Case Studies of Successful Debt Consolidation in the UK

Debt consolidation loans can be a beacon of hope for many individuals struggling with multiple debts. By combining various debts into a single loan with lower interest rates, borrowers can simplify their financial management and often save money over time. This section explores real-life examples of individuals in the UK who successfully navigated their financial challenges through debt consolidation, highlighting key factors that contributed to their success.

Real-Life Success Stories

Examining specific case studies provides valuable insights into the practical benefits and real-world implications of debt consolidation loans. Here are three compelling examples of individuals who turned their financial situations around through debt consolidation. Each case highlights their unique circumstances, decisions made, and the lessons learned.

| Name | Background | Debt Consolidation Action | Outcome | Key Takeaways |

|---|---|---|---|---|

| Sarah Johnson | In her late 30s, faced with £20,000 debt from credit cards and personal loans. | Consolidated debts into a £15,000 loan at a 6% interest rate. | Paid off all debts within 3 years, saving £2,500 in interest. |

|

| Mark Thompson | A 42-year-old with £25,000 debt from multiple sources, including a car loan and personal loans. | Obtained a debt consolidation loan of £20,000 at 5% interest. | Successfully eliminated his debt in 4 years, improving his credit score. |

|

| Emily Carter | Single parent with £15,000 in overdue bills and loans. | Consolidated her debts into a manageable £12,000 loan at 7% interest. | Cleansed her debt in 2 years, enabling her to plan for her children’s education. |

|

These case studies illustrate that with the right approach, debt consolidation can offer a fresh start, allowing individuals to regain control over their finances. The factors contributing to their success include diligent budgeting, commitment to repayment, and the pursuit of lower interest rates through consolidation. Each story reinforces the notion that informed financial decisions can lead to life-changing outcomes.

Future Trends in Debt Consolidation Loans in the UK

As the landscape of personal finance continues to evolve, debt consolidation loans in the UK are witnessing significant transformations. The combination of changing consumer behavior, regulatory requirements, and advancements in technology are propelling this evolution. Understanding these trends is essential for borrowers seeking to navigate the complex world of debt management.One of the most significant trends in the debt consolidation loan market is the increasing digitization of the application process.

Traditional banks and lenders are now facing competition from online-only platforms that provide streamlined and user-friendly experiences. This transition allows consumers to apply for loans from the comfort of their homes, gaining access to quicker decisions and often better rates. The convenience of technology is reshaping how individuals approach their financial needs, making debt consolidation more accessible than ever.

Technological Advancements in Lending

Technological advancements are not just improving the application process; they are also enhancing the overall lending landscape. The emergence of data analytics and artificial intelligence (AI) is revolutionizing how lenders assess creditworthiness. By utilizing algorithms that analyze various data points beyond traditional credit scores, lenders can offer more personalized loan options. This shift is especially beneficial for borrowers with less-than-perfect credit histories who may have previously been overlooked.The following are key technological influences shaping the debt consolidation market:

- Automated Decision-Making: Lenders are increasingly relying on AI to automate the approval process, allowing for rapid decision-making that can be completed in minutes rather than days.

- Enhanced Risk Assessment: With sophisticated analytics tools, lenders can evaluate risk more effectively, leading to potentially lower interest rates for qualified borrowers.

- Personalized Loan Products: Data-driven insights enable lenders to tailor loan products to meet individual needs, improving customer satisfaction.

- Blockchain Technology: Emerging blockchain solutions are being explored for secure and transparent loan transactions, minimizing the risk of fraud.

These advancements indicate a future where access to debt consolidation loans could be easier and more flexible, potentially resulting in a significant shift in how individuals handle their debts.

Predictions for the Future of Debt Consolidation Loans

Market analysis suggests that the demand for debt consolidation loans will continue to rise as economic pressures on consumers persist. Factors such as rising living costs and the aftermath of financial disruptions, including the pandemic, have led to increased borrowing among households. With this backdrop, the following predictions can be made about the future of debt consolidation loans:

- Increased Market Competition: As more fintech companies enter the space, traditional lenders will need to innovate and enhance their service offerings to maintain their customer base.

- Greater Regulatory Oversight: As the market grows, regulatory bodies may implement stricter guidelines to protect consumers, affecting how loans are marketed and issued.

- Education and Awareness: Financial literacy programs are likely to become more prevalent, helping consumers make informed decisions regarding debt consolidation and management.

- Integration of Financial Wellness Tools: Lenders may begin to offer additional resources, such as budgeting apps or financial counseling services, to support borrowers in managing their overall financial health.

In summary, the future of debt consolidation loans in the UK appears promising, driven by innovation and consumer empowerment. As the market evolves, borrowers will benefit from improved products and services that meet their increasingly diverse financial needs.

Question Bank: Debt Consolidation Loans UK

What exactly are debt consolidation loans?

Debt consolidation loans are loans taken out to pay off multiple debts, combining them into a single loan with one monthly payment.

Can I get a debt consolidation loan with bad credit?

Yes, some lenders offer debt consolidation loans specifically for individuals with bad credit, although the terms may not be as favorable.

How long does it take to get approved for a debt consolidation loan?

Approval times vary, but typically you can expect a decision within a few days to a couple of weeks, depending on the lender.

Are there any penalties for paying off a debt consolidation loan early?

Some lenders may impose early repayment fees, so it’s important to check the terms of your loan agreement.

Is it better to consolidate or manage debts separately?

It depends on your financial situation; consolidation can simplify payments and potentially lower interest, but managing debts separately may work better for some individuals.